Managing risk effectively is paramount in the volatile foreign exchange market. A tool designed for this purpose helps traders determine the appropriate amount of currency units to buy or sell in a given trade, based on their account size, risk tolerance, and the specifics of the trade setup. Understanding how this tool functions is crucial for preserving capital and maximizing trading potential.

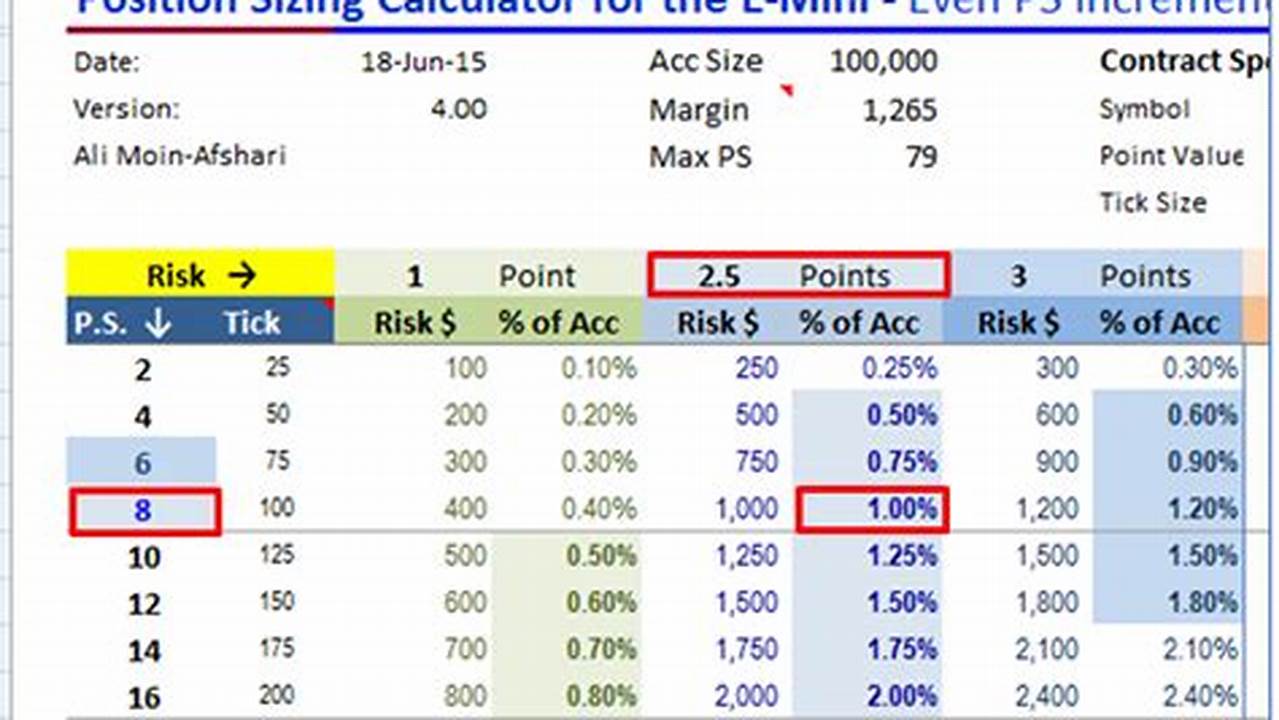

Account Size

The amount of capital available in a trading account forms the foundation of position sizing calculations. A larger account can theoretically support larger positions, but risk parameters must still be applied.

Risk Tolerance

This represents the percentage of the trading account a trader is willing to risk on a single trade. Conservative traders typically risk a smaller percentage (e.g., 1%), while more aggressive traders may risk a higher percentage.

Stop-Loss Level

This predetermined exit point limits potential losses if the trade moves against the trader. The distance between the entry price and the stop-loss level is a key factor in calculating position size.

Lot Size

A standardized unit of currency traded in forex. Calculations determine the appropriate lot size (standard, mini, micro) based on the other parameters.

Pip Value

Represents the monetary value of a single pip movement in the currency pair being traded. This value varies depending on the lot size and the currency pair.

Margin Requirements

The amount of capital a broker requires traders to hold in their account to open and maintain a position. This impacts the maximum position size a trader can take.

Currency Pair Volatility

More volatile currency pairs tend to require smaller position sizes to manage risk effectively, as price swings can be more significant.

Trading Strategy

Different trading strategies may necessitate adjustments to position sizing. Scalpers, for instance, may use smaller positions due to the higher frequency of trades.

Tips for Effective Usage

Tip 1: Consistent Application: Apply the chosen methodology consistently across all trades to maintain a disciplined approach to risk management.

Tip 2: Regular Review: Periodically review and adjust risk tolerance and position sizing strategies as market conditions and trading experience evolve.

Tip 3: Account Monitoring: Regularly monitor account balance and open positions to ensure adherence to risk management parameters.

Tip 4: Demo Account Practice: Practice utilizing position sizing calculations in a demo account before implementing them in live trading.

Frequently Asked Questions

How does it work?

It calculates the appropriate number of lots to trade based on your account size, risk tolerance, stop-loss level, and the pip value of the currency pair.

Why is it important?

It is essential for preserving trading capital and managing risk effectively in the forex market.

What are the benefits of using it?

Benefits include consistent risk management, protection against significant losses, and improved trading discipline.

Where can I find one?

Many online resources and trading platforms offer these calculators.

How do I choose the right risk percentage?

Consider your trading style, experience level, and comfort level with potential losses.

Can I adjust the settings?

Yes, most calculators allow customization based on individual risk preferences and trading strategies.

Mastering this crucial aspect of forex trading empowers traders to manage risk effectively and optimize their trading potential. By understanding the underlying principles and consistently applying appropriate calculations, traders can navigate the market with greater confidence and control.