Navigating the forex market can feel daunting for newcomers. Choosing the right currency pairs to trade is a crucial first step towards potential success. Appropriate currency pair selection can significantly impact a trader’s learning curve and early trading experience. Focusing on specific currency pairs allows beginners to develop a deeper understanding of market dynamics and refine their trading strategies without feeling overwhelmed by the sheer volume of available options.

Liquidity and Volatility

Prioritizing currency pairs with high liquidity ensures ease of entry and exit, minimizing slippage and potentially reducing trading costs.

Major Pairs

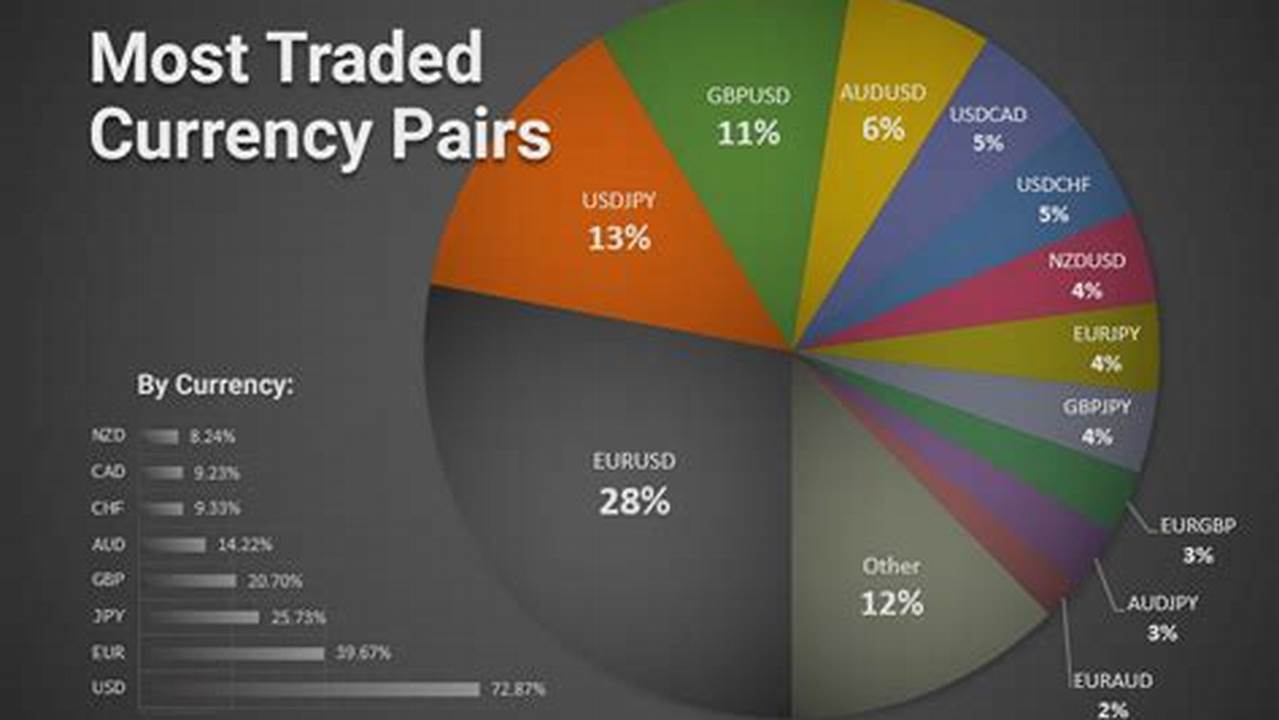

Major pairs, like EUR/USD and USD/JPY, offer substantial trading volumes and generally exhibit more predictable price movements, making them suitable for novice traders.

Minor Pairs

Minor pairs, such as EUR/GBP or AUD/NZD, can provide diversification opportunities but may exhibit slightly higher volatility compared to major pairs.

Exotic Pairs

Exotic pairs are generally not recommended for beginners due to their lower liquidity and higher volatility, which can lead to increased risk.

Economic Calendar Awareness

Staying informed about economic news releases and their potential impact on chosen currency pairs is essential for informed trading decisions.

Technical Analysis

Employing basic technical analysis tools can assist in identifying potential entry and exit points, contributing to a more structured trading approach.

Risk Management

Implementing effective risk management strategies, such as setting stop-loss orders and limiting leverage, is crucial for protecting capital.

Demo Account Practice

Practicing on a demo account allows beginners to gain experience and test different strategies without risking real funds.

Tips for Selecting Suitable Currency Pairs

Focus on a limited number of currency pairs initially to develop a strong understanding of their behavior.

Consider pairs with readily available educational resources and analysis.

Align chosen pairs with individual trading styles and risk tolerance.

Regularly review and adjust trading strategies based on market conditions.

Frequently Asked Questions

Why are major currency pairs recommended for beginners?

Major pairs offer high liquidity and relatively stable price movements, creating a more predictable trading environment for learning.

What are the risks of trading exotic currency pairs?

Exotic pairs often have low liquidity and high volatility, leading to wider spreads and increased risk of rapid price fluctuations.

How can economic news impact currency pair values?

Economic news releases can significantly influence investor sentiment and market dynamics, causing substantial price movements in affected currency pairs.

Why is demo account practice important?

Demo accounts allow traders to gain practical experience and refine their strategies in a risk-free environment before trading with real capital.

What is the role of technical analysis in forex trading?

Technical analysis utilizes historical price data and chart patterns to identify potential future price movements and assist in making informed trading decisions.

How can I manage risk effectively in forex trading?

Effective risk management involves setting stop-loss orders, limiting leverage, and diversifying trading portfolios to minimize potential losses.

Selecting the right currency pairs is a foundational element of successful forex trading for beginners. By focusing on liquid and less volatile pairs, utilizing available educational resources, and practicing sound risk management techniques, new traders can build a solid foundation for long-term success in the forex market.