Navigating the foreign exchange market can be daunting for newcomers. A comprehensive introductory resource specifically tailored for novice traders offers essential knowledge and practical guidance to understand and participate in this dynamic market. Such a resource equips aspiring traders with the foundational concepts, tools, and strategies necessary for informed decision-making.

Understanding the Basics

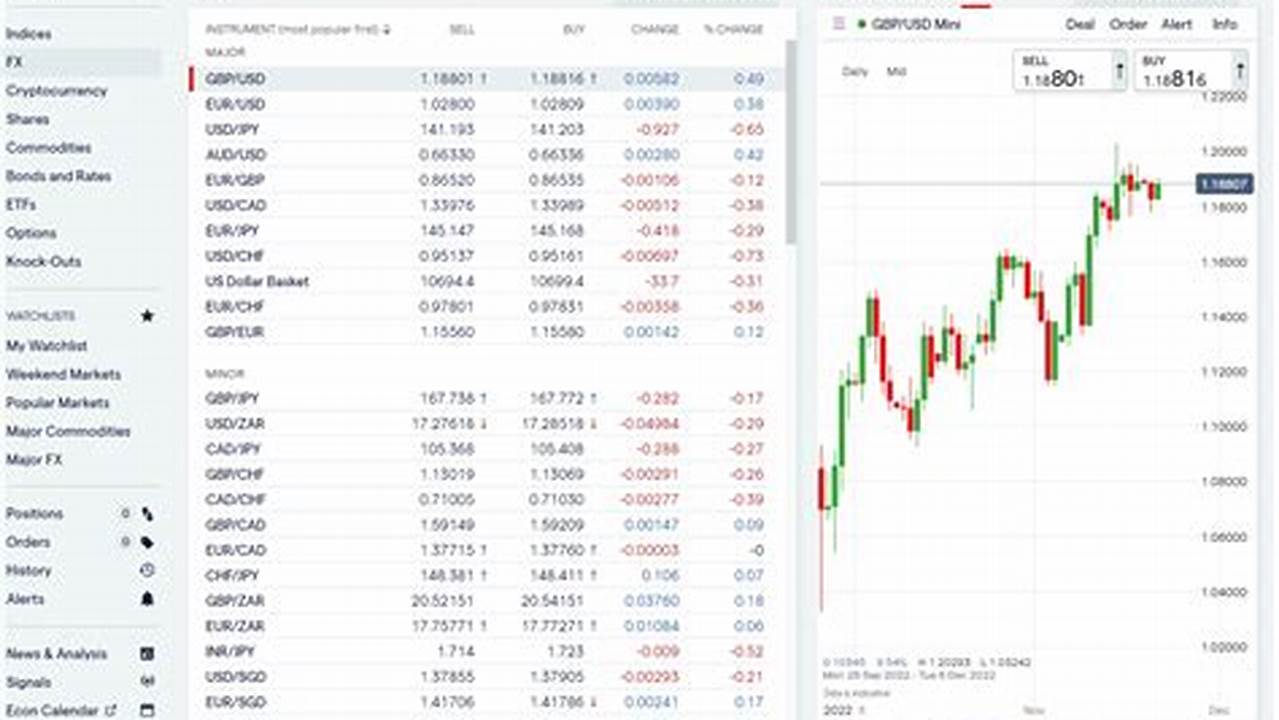

A solid foundation in foreign exchange trading principles is crucial. This includes understanding currency pairs, pips, lots, leverage, margin, and the factors influencing currency fluctuations.

Choosing a Reliable Broker

Selecting a reputable and regulated broker is paramount for secure trading. Key considerations include regulatory compliance, trading platform features, customer support, and associated fees.

Developing a Trading Plan

A well-defined trading plan acts as a roadmap for success. This involves setting realistic goals, defining risk tolerance, establishing entry and exit strategies, and maintaining disciplined execution.

Risk Management

Protecting capital is fundamental to long-term success. Implementing effective risk management techniques, such as stop-loss orders and position sizing, helps mitigate potential losses.

Technical Analysis

Learning technical analysis tools and indicators empowers traders to identify potential trading opportunities based on historical price patterns and market trends.

Fundamental Analysis

Understanding fundamental analysis provides insights into economic factors that influence currency values. This includes analyzing news releases, economic indicators, and geopolitical events.

Demo Account Practice

Practicing on a demo account allows novice traders to gain practical experience without risking real capital. This provides a safe environment to test strategies and refine trading skills.

Continuous Learning

The forex market is constantly evolving. Continuous learning through educational resources, market analysis, and staying updated on industry trends is essential for ongoing improvement.

Building a Trading Mindset

Developing a disciplined and patient trading mindset is crucial for managing emotions and making rational decisions in a volatile market environment.

Tips for Beginners

Start Small: Begin with smaller trade sizes to minimize potential losses while gaining experience.

Keep Learning: Continuously expand your knowledge through educational resources and market analysis.

Manage Emotions: Avoid emotional decision-making and stick to your trading plan.

Practice Patience: Successful trading requires patience and discipline. Avoid impulsive actions.

Frequently Asked Questions

What is Forex Trading?

Forex trading involves buying and selling currencies in the foreign exchange market with the aim of profiting from price fluctuations.

How Do I Start Forex Trading?

Starting forex trading typically involves choosing a reputable broker, opening a trading account, funding the account, and utilizing a trading platform to execute trades.

What are the Risks of Forex Trading?

Forex trading carries inherent risks, including the potential for significant losses due to market volatility, leverage, and unforeseen events.

Is Forex Trading Suitable for Beginners?

While forex trading can be challenging, beginners can participate by educating themselves thoroughly, starting with small investments, and practicing on demo accounts.

What is the role of a Forex broker?

A Forex broker acts as an intermediary between you and the foreign exchange market, providing access to a trading platform and facilitating your trades.

How can I manage risks in Forex trading?

Risk management involves using tools like stop-loss orders, limiting leverage, and diversifying your trades to protect your capital.

Entering the world of forex trading requires careful preparation and a commitment to continuous learning. A dedicated beginner’s guide serves as a valuable compass, guiding aspiring traders through the complexities of the forex market and empowering them to make informed decisions on their trading journey.